Behind the AmLaw 100 Numbers; Non-Equity Growth

Behind the AmLaw 100 Numbers

The American Lawyer published its annual AmLaw 100 report two weeks ago. Despite significant challenges in the broader economy, the AmLaw 100 as a whole saw revenue gains of 2.7% in 2022, over an already high bar set in 2021. However, the gains were concentrated in a smaller number of firms (41 of the 100 posted gains; 59 did not). This stands in stark contrast to 2021, where all 100 firms saw revenue growth.

Gretta Rusanow of Citibank Law Firm Group and Kent Zimmermann of the Zeughauser Group note that practice area mix likely played a role in the uneven results; generally, firms with relative weight in litigation fared better in 2022, while firms with relative weight in large transactions fared worse due to reduced deal flow and increased headcount at higher compensation from robust hiring during the frothy deal environment of 2021 & early 2022 (A Step Back, But Still Ahead? An Analysis of The 2023 Am Law 100, Patrick Smith, 4/18/23, The American Lawyer).

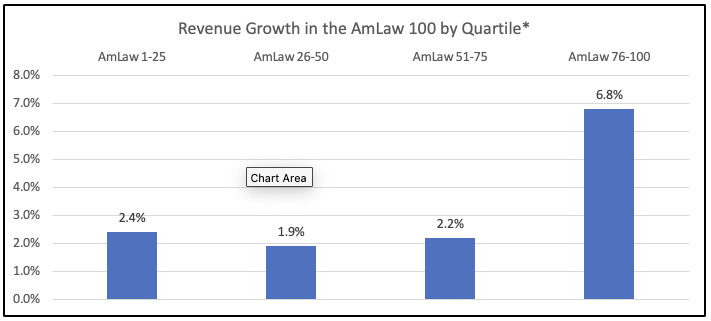

A breakdown of the AmLaw 100 by quartile supports this theory. Across several measures, the 4th Quartile (76-100) outperformed the others, while the 2nd Quartile (26-50) finished last.

*The AmLaw 76-100 outperformed the other quartiles on Revenue Growth, likely due to practice mix (relatively more litigation), as well as less reliance on large M&A deals and more focus on midmarket M&A (All Eyes Are on the Middle Market as Larger Firms See Big Money in Smaller Deals, Jessie Yount 4/3/23, American Lawyer).

**The AmLaw 76-100 and 51-75 outperformed the other quartiles on Revenue per Lawyer, likely due to the fact that these firms did not bulk up as robustly during the boom times in order to staff large M&A deals.

***The AmLaw 76-100 likely saw less of a hit to Profits per Equity Partner (PEP) because these firms did not chase the compensation increases of firms in the upper tiers of the Am Law100. Interestingly, the AmLaw 26-49 saw the biggest drop in PEP by far, perhaps because they participated fully in the hiring frenzy, while also significantly increasing compensation of associates & non-equity partners, but ultimately lacked the same leverage to raise rates as the AmLaw 1-25.

Taking a broader view, the AmLaw 100 has done very well over the last 10 years. PEP increased 74% over that span and Profits per Lawyer increased 51.7%. Relatedly, Revenue per Lawyer increased 37.7% over the last decade, outpacing Cost per Lawyer growth (29.1%), despite significant increases in associate compensation. Although the AmLaw 100 saw a reduction in equity partners as a % of firm lawyers over that period (more on that below), most of the PEP growth is likely not the result of shrinking equity pools and is more likely attributed to rate increases, higher utilization, and improved operating efficiencies (The Long View: A 10-Year Look at Key Financial Metrics “The Long View”, Gina Passarella Cipriani, 4/18/23, The American Lawyer). As Patrick Fuller VP of ALM Intelligence summed it up: “This last three- to five-year stretch is the best three- to five-year stretch [for the AmLaw 100] in history…” (Some Lost, Much Gained: Thoughts on 2022 and What's to Come, Gina Passarella Cipriani, 4/18/23, The American Lawyer).

Non-Equity Growth

Despite the drop in profits in 2022, the Am Law 100 increased equity partner ranks by 1% in headcount over last year’s total (The Am Law 100 Shared More of the Wealth in 2022, but It Won't Last For Long, Andrew Maloney, 4/18/23, The American Lawyer). In fact, equity partner ranks have grown 6.7% over the last decade. However, total lawyer headcount among the AmLaw 100 has grown more rapidly than the equity tier. As a percentage of firm lawyers, equity partner ranks have experienced a steady decline over the last 10 years, ranging from highs of 21.9% in 2013 and 22% in 2014 to lows of 19.7% in 2021 and now 19% in 2022 (The Long View). In contrast, non-equity partners have experienced a steady increase as a percentage of firm lawyers, from 14.8% in 2013 to 17.4% in 2022.

If these trends continue, non-equity partners should overtake equity partners in headcount over the next few years (The Long View). The continued growth of non-equity partner classes may be sound strategy for the AmLaw 100: 1) promotions to non-equity partner can help firms to retain experienced attorneys whom clients have come to value; and 2) non-equity partners require no training, command higher billable rates, collect at higher realization rates, and turnover less than associates (Crazy Like A Fox - Why the Increase in Nonequity Partners (and Decrease in Associate Ranks) Makes Business Sense, Edwin B. Reeser and Patrick J. McKenna, 2/1/2012, The American Lawyer). And although non-equity partners earn more in compensation, associate compensation increases have narrowed that delta in recent years.