Double Digit PPP Growth?; Demand by Practice; Rate Growth

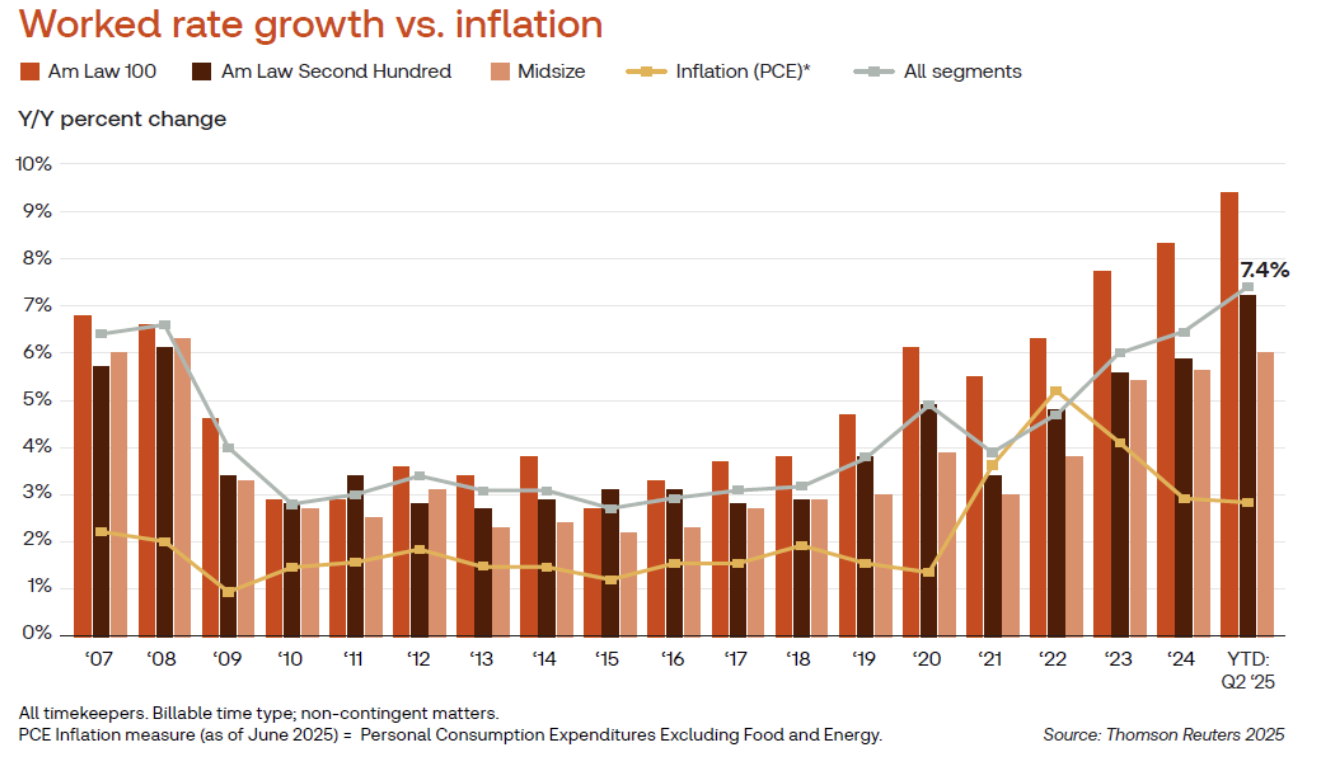

Q3 2025 was favorable for most large law firms. Demand growth, as measured by hours worked, was up 3.9% over Q3 2024 across all segments (AmLaw 100, Second Hundred, and Midsize firms), placing Q3 2025 among the top-ranking quarters for demand growth in the last twenty years. Impressively, this growth was "driven by sustained client activity," in contrast to the high growth quarters in 2021, which were really a return to baseline from pandemic lows. By segment, Midsize firms & the AmLaw Second Hundred led the way with 4.9% and 4.3% demand growth, respectively; the AmLaw 100 registered only 1.7% demand growth but still maintains an advantage in worked rate growth (LFFI Report).

Frothy Market; Hiding Partner Promotions; Vetting Client Portability

Big Law is doing quite well so far in 2025, despite economic uncertainty and adverse actions taken by the Trump Administration earlier this year. The lateral partner market has been active as well, with 2,888 lateral moves to AmLaw 200 firms through the month of September. These moves eclipse the 2024 tally of 2,687 through the same period, as well as the prior 3 year average of 2,574.

Eye of the Hurricane?; Rates Undisrupted; Demand by Practice Area

Q2 2025 was favorable for most large law firms. As uncertainty in the economy and the geopolitical landscape mounted, clients increasingly relied on outside counsel for guidance, echoing the surge in worked-rate growth seen during the early stages of the pandemic.

Inflated Books of Business; Client Stickiness; Assessing Portability

Decipher Investigative Intelligence conducts due diligence on lateral partner hiring for law firms. In its most recent report, Decipher developed an average lateral partner candidate profile for 2024 and compared it to prior years. Decipher reported the average book of business projected by lateral candidates in 2024 at $2,964,107, up 73% over 2023 and up 110% over the previous 3-year average.

Partner Headcount Growth; Capital Contributions; Compensation Spreads

ALM released its NLJ 500 Report last month, ranking the 500 largest firms in the U.S. by headcount. Headcount grew 5.5% overall, with the average NLJ 500 firm reporting 396 full-time attorneys (NLJ Report). In both the NLJ 500 and the AmLaw 200, non-equity partner headcount growth significantly outpaced equity partner headcount growth in the aggregate. However, because lawyers in the AmLaw 100 comprise such a significant percentage of the headcount of both the NLJ 500 and the AmLaw 200, it is worthwhile to examine partner headcount growth by segment. Interestingly, there was no significant headcount growth of equity partners in the AmLaw 100 or in the NLJ 500 firms outside of the AmLaw 200 ("non-AmLaw" firms). In the AmLaw Second Hundred, however, both equity and non-equity partner tiers grew at roughly the same rate (6.01% vs. 6.63%).

Partner Compensation Models;Behind the Numbers; DEI Thesaurus

ALM Pacesetter Research released its "Innovation in Law Firm Partner Compensation Models" Report on June 5th ("Report"). Compensation is critical to both retaining current partners and attracting lateral partners. 63% of partners surveyed by ALM noted that compensation is the most impactful factor influencing their decision to explore partnership at a different firm (Report, citing ALM's 2025 New Partners Survey Results Study).

Q1 Performance; AmLaw 100 & 200; Mansfield Rule

Firms were able to grow rates substantially in Q1 2025, according to both Thomson Reuters' Q1 Law Firm Financial Index and Wells Fargo Legal Specialty Group's Q1 Survey, reporting average worked growth of 7.3% and average standard rate growth of 9.5%, respectively.

Partner Rates; Billable Targets; Reason to Leave?

ALM released its Attorney Compensation Survey in January, which included the average standard hourly rate charged by both equity and non-equity partners as of 1/1/2024 at firms of varying size (Attorney Compensation Survey, ALM Intelligence, Jan. 2025). Interestingly, billing rates increased with firm size in a nearly linear fashion, for both equity and non-equity partners..

State of the Legal Market; Lateral Partner Hiring; Golden Handcuffs

Profits per equity partner (PEP) grew 11.6% in 2024, one of the strongest PEP performances in recent years, according to the State of the Legal Market Report by Georgetown University Law Center and Thomson Reuters. According to the Report, profit growth was the result of both worked rate growth (6.5%) and demand growth (2.6%).

Leverage; Equity Partner Growth; Capital Contributions

Citi and Hildebrandt released their 2025 Client Advisory, predicting that 2025 will be a "very good year" for law firms (Citi Hildebrandt Client Advisory "Client Advisory", Greta Rusanow & Brad Hildebrandt, 12/5/24). They anticipate continued demand in practices that have fueled a strong 2024 (namely litigation, regulatory (particularly anti-trust), funds/investment management, bankruptcy and restructuring); they also forecast the "return of M&A, corporate and transactional work broadly across all segments, as interest rates continue to fall and market conditions improve" (Client Advisory).

Q3 Demand Growth; Rate Charts by Practice

Law firms are expected to register profit growth at year-end 2024, as firms have successfully increased rates, headcount, and productivity ("getting more out of each lawyer"), according to Thomson Reuters Law Firm Financial Index which tracks and analyzes billing and financial data for 171 U.S.-based law firms, including 51 Am Law 100 firms, 55 Am Law Second Hundred firms, and 65 Midsize firms.

Partner Comp by Practice Group; Comp Cuts; Return to Office

MLA released its 2024 Partner Compensation survey, including responses from 1,718 partners in the AmLaw 100 and 200. Partners in all practice areas saw compensation increases relative to the 2022 and 2014 surveys, reflecting firms' continued profit growth, largely due to continued rate increases.

Rosy Outlook; Relative Performance Measures; Underwriting Laterals

Law firms are on track to produce "one of the strongest years we see," according to Gretta Rusanow, head of advisory services for Citi's Law Firm Group (Law Firms Could Post 'One of the Strongest Years We See', Andrew Maloney, 8/19/24, American Lawyer). Citi's recent report analyzed the first 6 months of 2024, relative to the same period in 2023, and found demand and productivity growth of 2.9% and 2.1% respectively and double-digit revenue growth (11.4%).

Q2 Performance. Is Size a Winning Strategy? Where Are They Now?

Q2 was a productive quarter for most law firms, according to Thomson Reuters Law Firm Financial Index which tracks and analyzes billing and financial data for 171 U.S.-based law firms, including 51 Am Law 100 firms, 55 Am Law Second Hundred firms, and 65 Midsize firms (Law Firm Financial Index Q2 2024 Executive Report “LFFI Report”, 8/5/24). Most practice areas experienced demand growth relative to Q2 2023.

Pay Spread; Tweaking Comp Models; Succession Planning

The American Lawyer reported last month that the "Am Law 100 upped its average equity partner pay spread from 9.8-to-1 in 2022 to 10.3-to-1 in 2023" (Largest Law Firms Increase Partner Pay Spread, as Comp Models Hit 'Inflection Point', Andrew Maloney, 5/28/24). In my experience, median equity partner pay spread figures are more instructive than averages. Averages among the AmLaw 100 and Second Hundred have been skewed by outliers like Fisher Broyles.

Financial Performance; AI’s Impact on Big Law Economics; Influencing Origination Credit

The new AmLaw 100 survey was released last month, revealing that 2023 was a good year for many firms. Out of 100, only 10 posted revenue declines in 2023. Only 20 declined in profits per equity partner. And nearly three-quarters of Am Law 100 law firms raised the average compensation of all firm partners, equity and non-equity.

Strings Attached; Growth for Growth's Sake; Mental Health; Summer Slowdown

Firms are increasingly using bonuses structured as forgivable loans to compensate laterals and current partners. These loans not only help with retention, but also give firms flexibility to compensate outside of their typical formula or structure without raising eyebrows from the partnership at large, since firms do not have to report these loans on a partner's compensation schedule.

Return to Profit Growth; Optimism in 2024; Office Space

Profits per equity partner (PEP) among surveyed law firms grew by 6.6% in 2023, according to Citi’s Global Wealth at Work Law Firm Group (Law Firms Witnessed a 'Return to Profit Growth' in 2023 ("Return to Profit"), Justin Henry, 2/9/24, American Lawyer). There was dispersion however, as 39% of firms surveyed reported decline in PEP (Return to Profit).

2023 in Review; Legal Spend & Rates; Blackbox Compensation

2023 was a better year than 2022 on several key performance measures, according to Thomson Reuters and the Center on Ethics & the Legal Profession at Georgetown University Law Center (2024 Report on the State of the U.S. Legal Market “Report”, Jim Jones - Lead Author, 1/8/24) (analyzing data through Nov. 2023 from 179 US-based law firms, including 48 Am Law 100 firms, 49 Am Law Second Hundred firms, and 782 Midsize firms).

Financials; Rates; & Mergers

Most law firms believe they will meet or beat expectations in 2023," largely due to conservative budgeting. However, Thomson Reuter's Law Firm Financial Index Q3 Report ("Q3 Report") predicts disparate year-end results by law firm segment.