Partner Headcount Growth; Capital Contributions; Compensation Spreads

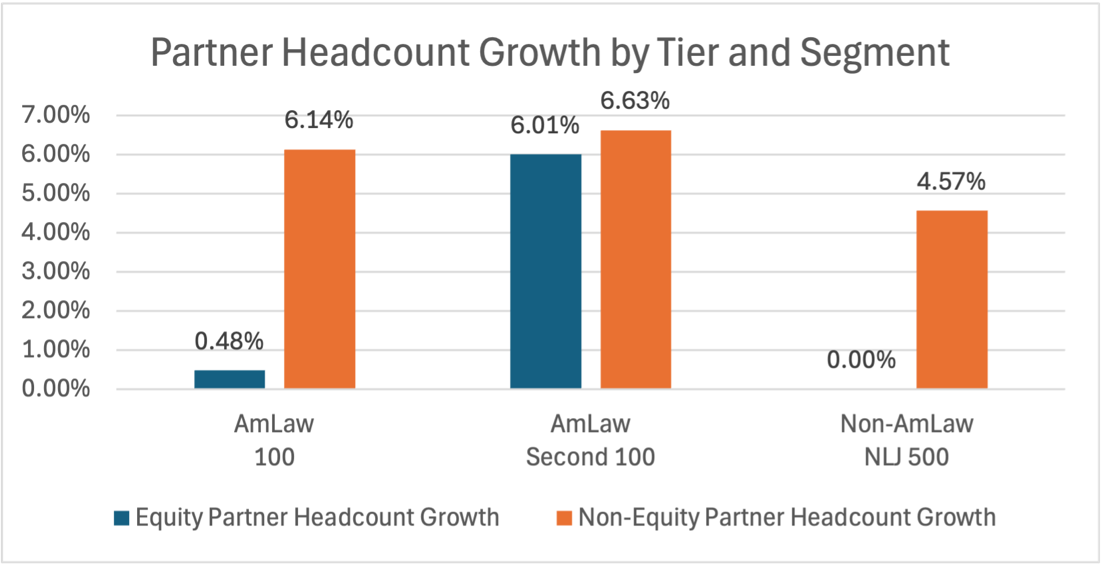

ALM released its NLJ 500 Report last month, ranking the 500 largest firms in the U.S. by headcount (The 2025 NLJ 500: After Head Count Growth Exploded Last Year, Law Firms Pull in the Reins "NLJ Report", Abigail Adcox, 6/5/25, Law.com). Headcount grew 5.5% overall, with the average NLJ 500 firm reporting 396 full-time attorneys (NLJ Report). In both the NLJ 500 and the AmLaw 200, non-equity partner headcount growth significantly outpaced equity partner headcount growth in the aggregate. However, because lawyers in the AmLaw 100 comprise such a significant percentage of the headcount of both the NLJ 500 and the AmLaw 200, it is worthwhile to examine partner headcount growth by segment. Interestingly, there was no significant headcount growth of equity partners in the AmLaw 100 or in the NLJ 500 firms outside of the AmLaw 200 ("non-AmLaw" firms). In the AmLaw Second Hundred, however, both equity and non-equity partner tiers grew at roughly the same rate (6.01% vs. 6.63%).

Capital Contributions

Capital contributions are expected to continue to rise, to account for investments in technology, AI, and entry into new markets (Partners' Capital Contributions Are Expected to Rise as Expenses and Uncertainty Expand, Andrew Maloney, 6/17/25, Law.com, citing 2025 Citi Hildebrandt Client Advisory). Since the Great Recession, firms have attempted to rely less on banks for liquidity and more on the partnership. However, any capital calls may hit partners harder than in years past, as equity partners account for an increasingly smaller percentage of headcount - meaning the financial burden of a relatively larger enterprise is shared among relatively fewer individuals.

According to Wells Fargo’s Legal Specialty Group, the average capital requirement of an AmLaw 100 and Second Hundred partner was approximately 23% and 19.5%, respectively, of their compensation in 2023. But the range among firms varied widely from 0% to 49%.

In addition to funding investments, capital contributions can act as golden handcuffs, either psychologically or in fact as firms slow-play repayment and/or threaten forfeiture of capital for missteps in the departure process.

Partner Comp Spreads

ALM released its annual partner compensation ratio survey, reporting the ratio of a firm’s highest-compensated equity partner to that of its lowest-compensated equity partner. The average spread within the AmLaw 100 increased from 10.3 to 1 in 2023 to 12.3 to 1 in 2024. I've written previously that averages for this particular metric are not always instructive because outliers, such as Fisher Broyles' ratio of 1,010 to 1 in 2020, can significantly skew the average. In 2023 and 2024, however, there were no outliers.

The increased average comp ratio lends credence to a trend that many recruiters and industry observers have noted, namely that there is competitive pressure among AmLaw 100 firms to increase their spread to attract and retain high-performing partners. Not all AmLaw 100 firms increased their ratio, however; 23% of reporting firms reduced their ratio and 16% maintained the same ratio.