Partner Compensation; Dynamic vs. Static Firms

Partner Compensation

An article by the Wall St. Journal examining banker and lawyer pay revealed partner profits at major law firms have tripled over the past two decades, while pay for similarly situated banking directors has remained stagnant (On Wall Street, Lawyers Make More Than Bankers Now, Cara Lombardo, 6/22/23, Wall Street Journal). The Journal cites several reasons for the inversion:

lawyers have become “quasibankers, serving as sounding boards for corporate executives as they clash with regulators or wrestle with thorny issues such as succession planning”;

the rise of private equity has fueled law firm profits;

law firm rates have risen annually, while banking deal fees have remained flat; and

law firms have moved away from lock-step partner compensation based on seniority, which has created bidding wars for top producers.

The American Lawyer annually ranks the two hundred law firms with the largest revenue in its AmLaw 200 publication; ranked firms submit financial data, including profits per equity partner and total non-equity partner compensation.

a. Profits per Equity Partner (PEP)

Currently, 51 of the AmLaw 200 firms have an office in North Carolina. There is quite a large PEP range among these firms, from $4.73M PEP at the higher end to $378K at the lower end. The average PEP among these 51 firms is $1.4M (the median is $1.14M).

b. Comp Ratios among Equity Partners

Average PEP within a firm only tells part of the story; the American Lawyer also collects data on the compensation ratio of the highest paid equity partner at a particular firm to the lowest paid equity partner. For example, if the reported ratio is 10:1 and the lowest paid equity partner earned $500K, then the highest paid equity partner would receive ten times that number, or $5M.

Thirty of the 51 AmLaw 200 firms with a North Carolina presence reported this data. The average reported ratio was 10:1, ranging from a high of 30:1 to a low of 3.7:1. The median ratio was 7:1, compared to a median ratio of 8.6:1 in the AmLaw 200 at large (Partner Pay Spread Condensed Across Big Law, as Head Count Rose and Profits Shrunk, Andrew Maloney, 6/5/23, American Lawyer).

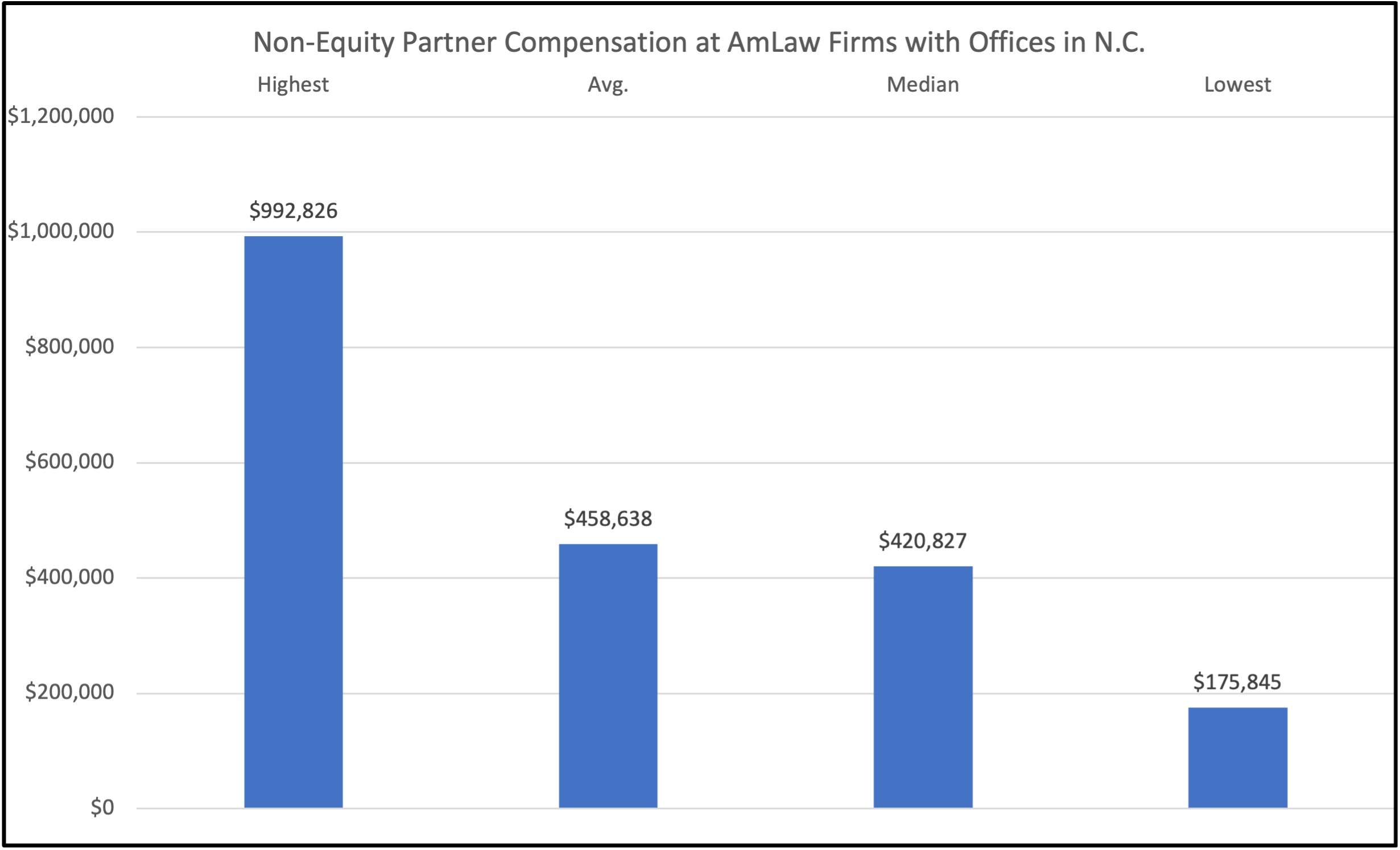

c. Non-equity Partner Compensation

Forty-nine of the 51 AmLaw 200 firms with an office in N.C. have a two-tiered partner system (equity and non-equity). Average non-equity partner compensation among those 49 firms is $458,638; the median is $420,827.

“Dynamic” Law Firms

Thomson Reuters issued a report last month aimed at identifying what has helped high-growth law firms succeed over the last decade (2023 Dynamic Law Firm Report, Thomson Reuters Institute, June 2023). Thomson Reuters grouped firms in the top 25% in both Profit-per-Lawyer (PPL) and Revenue-per-Lawyer (RPL) growth over the last decade (labeled as “Dynamic firms”) and firms in the bottom 25% (labeled as “Static firms”) and then compared the groups to each other and to the average law firm, on a host of measures including demand, worked rates, fees worked, productivity, and lawyer headcount. Although firm size was not determinative of success, the AmLaw 100 made up 60% of Dynamic firms and only 12% of Static firms (Dynamic firm group composition: AmLaw 100 (60%), AmLaw Second Hundred (20%); and Midsize (20%); Static firm group composition: AmLaw 100 (12%); AmLaw Second Hundred (48%), and Midsize (40%)).

Dynamic firms registered demand growth (hours worked) over the last decade, despite increasing rates, and experienced less of a productivity drop (hours per lawyer), despite increasing headcount. Static firms by contrast registered 0% demand growth over the last decade (compared to Dynamic firms 1.7% growth) and endured more volatile demand swings.

Practice mix may offer some explanation for the delta in demand growth. Over the last decade, Dynamic firms grew their transactional practices 6.9% as a proportion of total firm hours billed across practice areas (compared to 2.7% transactional growth at Static firms). Relatedly, dynamic firms also shrunk their litigation practices 4.6%, as a proportion of total firm hours billed. This relative shift in practice mix matters because transactional demand increased 2.3% over the last decade, while litigation demand fell -0.2%; and transactional work can command higher rates.

Static firms did hold an advantage in realization rates. Thomson Reuters suggests however that Static firms would be better offer sacrificing realization, in favor of increasing rates. Thomson Reuters further argues that offering a lower-cost alternative in order to increase market share is not an effective strategy, at least for the cohort of Static firms; Dynamic firms saw demand growth of 1.7% despite a worked rate increase of 4.1%, while Static firms saw 0% demand growth, while raising rates only 2.8%. Thomson Reuters suggests that Static firms offer pricing and sales training to their partners and acquire comparative rate data on peer firms to give their partners more confidence in raising rates.