Double Digit PPP Growth?; Demand by Practice; Rate Growth

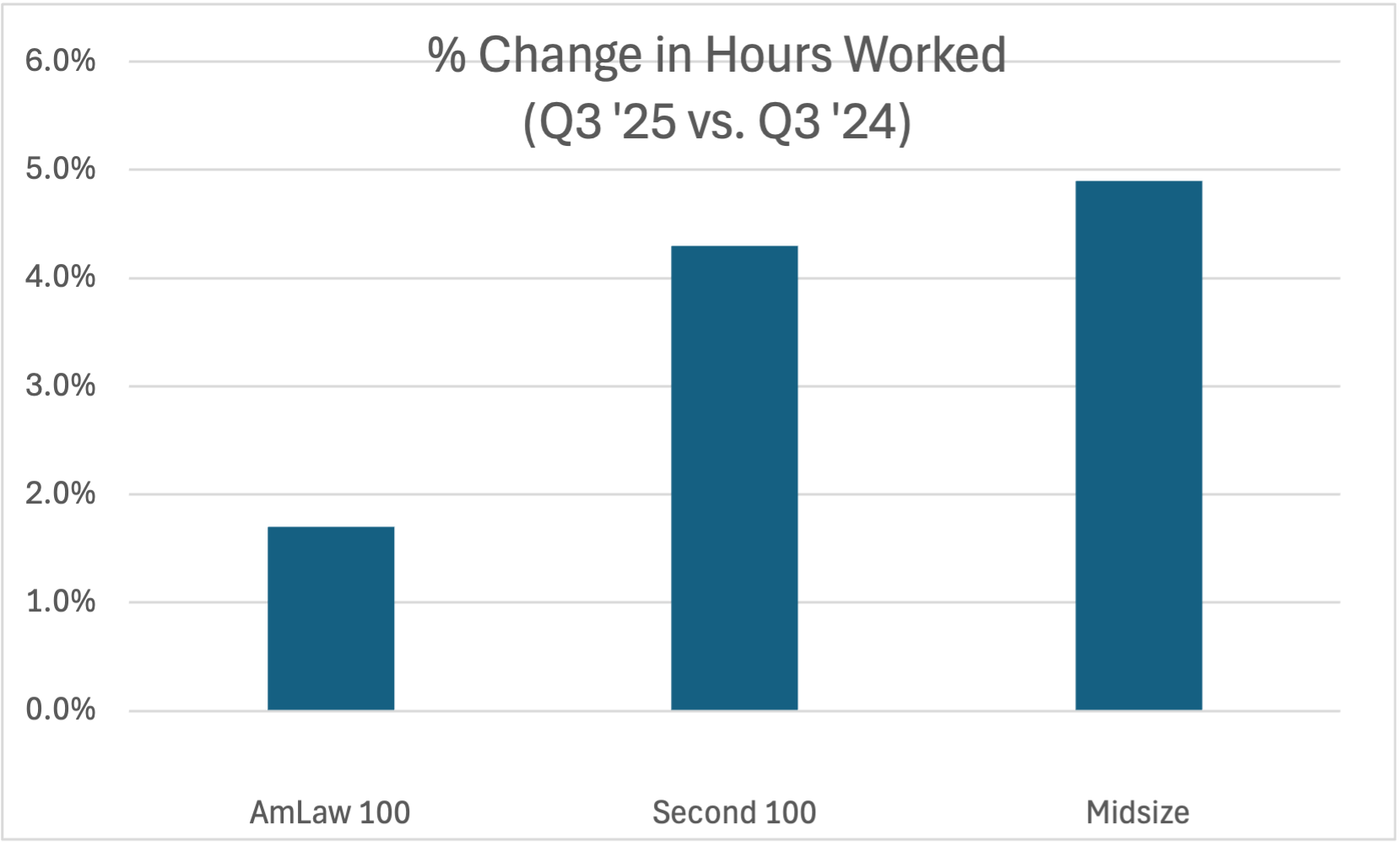

Q3 2025 was favorable for most large law firms (Law Firm Financial Index Q3 2025 Executive Report “LFFI Report”, 11/10/25, Thomson Reuters) (tracking and analyzing billing and financial data for 171 U.S.-based law firms, including 51 Am Law 100 firms, 55 Am Law Second Hundred firms, and 65 Midsize firms). Demand growth, as measured by hours worked, was up 3.9% over Q3 2024 across all segments (AmLaw 100, Second Hundred, and Midsize firms), placing Q3 2025 among the top-ranking quarters for demand growth in the last twenty years. Impressively, this growth was "driven by sustained client activity," in contrast to the high growth quarters in 2021, which were really a return to baseline from pandemic lows. By segment, Midsize firms & the AmLaw Second Hundred led the way with 4.9% and 4.3% demand growth, respectively; the AmLaw 100 registered only 1.7% demand growth but still maintains an advantage in worked rate growth (LFFI Report).

Consistent with the LFFI Report, Gretta Rusanow, head of advisory services for Citi’s Global Wealth at Work Law Firm Group, noted revenue growth of 11.3% across the industry through Q3, largely due to rate increases (Am Law 50 Revenue Up 12% Through Q3, As More Law Firms Seek Scale Amid Rising Costs, "Revenue Up," Andrew Maloney, 11/10/25, Law.com). Rusanow expects double digit profit growth at some firms for 2025 and mid-to-high single digit growth for the industry, assuming collections go well. Rusanow noted that firms typically collect 1/3 of their yearly revenue in Q4 and half of that in the very last month (Revenue Up).

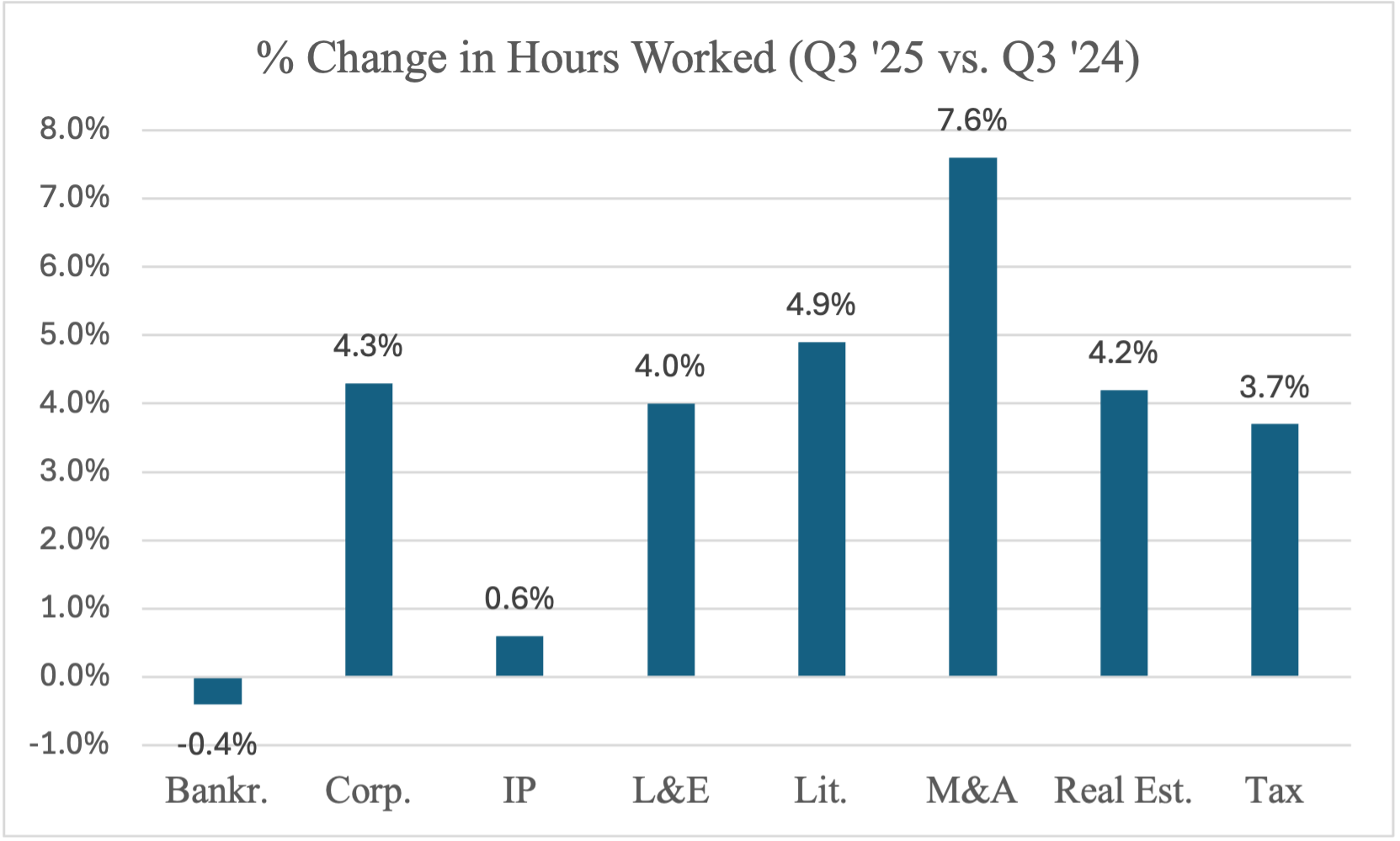

Demand by Practice Area

M&A surged ahead in Q3, perhaps reflecting pent-up demand from a slower Q2 (LFFI Report). Similarly, Rusanow from Citi noted a recent “acceleration in mid-market M&A activity" (Revenue Up).

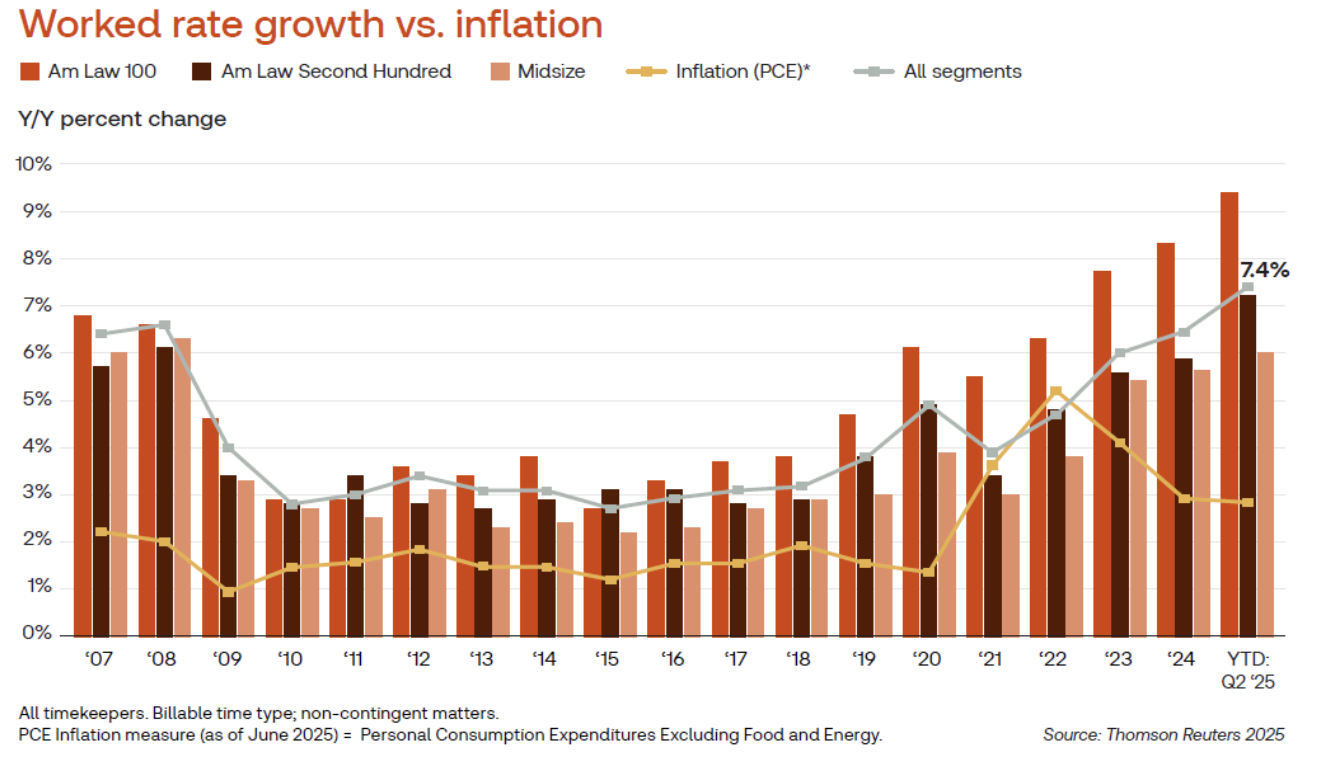

Rate Growth

BigLaw’s primary super-power is its ability to push through substantial rate increases year after year. According to Thomson Reuters' Law Firm Rate Report, worked rate growth significantly outpaced inflation for much of the last two decades; and so far in 2025, worked rates are up 7.4%, with inflation at 2.8% ("Rate Report", Thomson Reuters & TVPI, Oct. 2025).

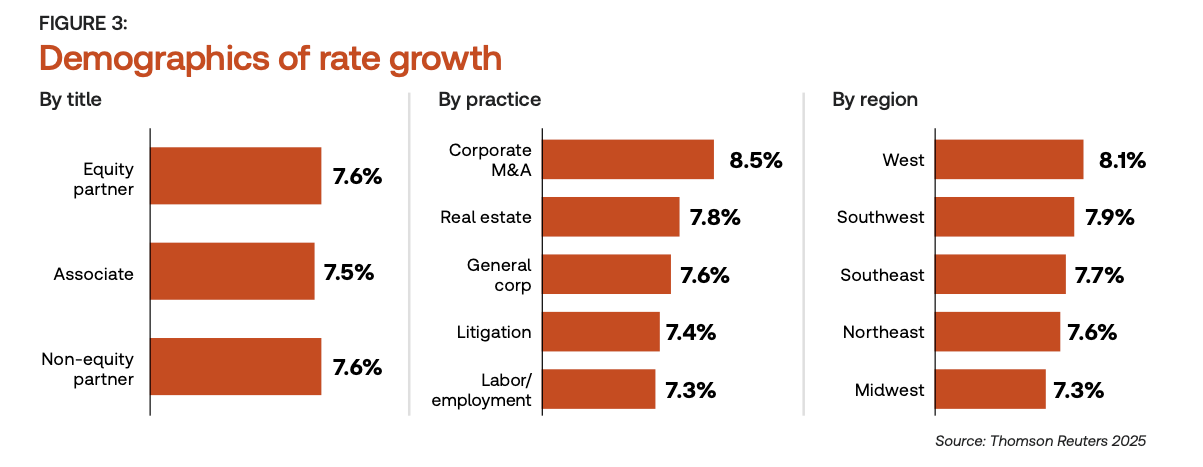

In 2025, worked rates have grown evenly across titles (equity, non-equity, and associate), and worked rates have been relatively consistent across practice areas, with M&A leading the way at 8.5% rate growth and L&E on the lower end with 7.3% growth.

Interestingly, the Rate Report concluded that firms "consistently collect similar amounts per hour despite employing highly distinctive realization strategies."