Eye of the Hurricane?; Rates Undisrupted; Demand by Practice Area

Q2 2025 was favorable for most large law firms. As uncertainty in the economy and the geopolitical landscape mounted, clients increasingly relied on outside counsel for guidance, echoing the surge in worked-rate growth seen during the early stages of the pandemic.

Overall demand was up 1.6% in the second quarter over Q2 2024 and was relatively steady throughout the quarter, i.e. not on a downward slope from beginning to end (Law Firm Financial Index Q2 2025 Executive Report “LFFI Report”, 8/27/25, Thomson Reuters) (tracking and analyzing billing and financial data for 171 U.S.-based law firms, including 51 Am Law 100 firms, 55 Am Law Second Hundred firms, and 65 Midsize firms).

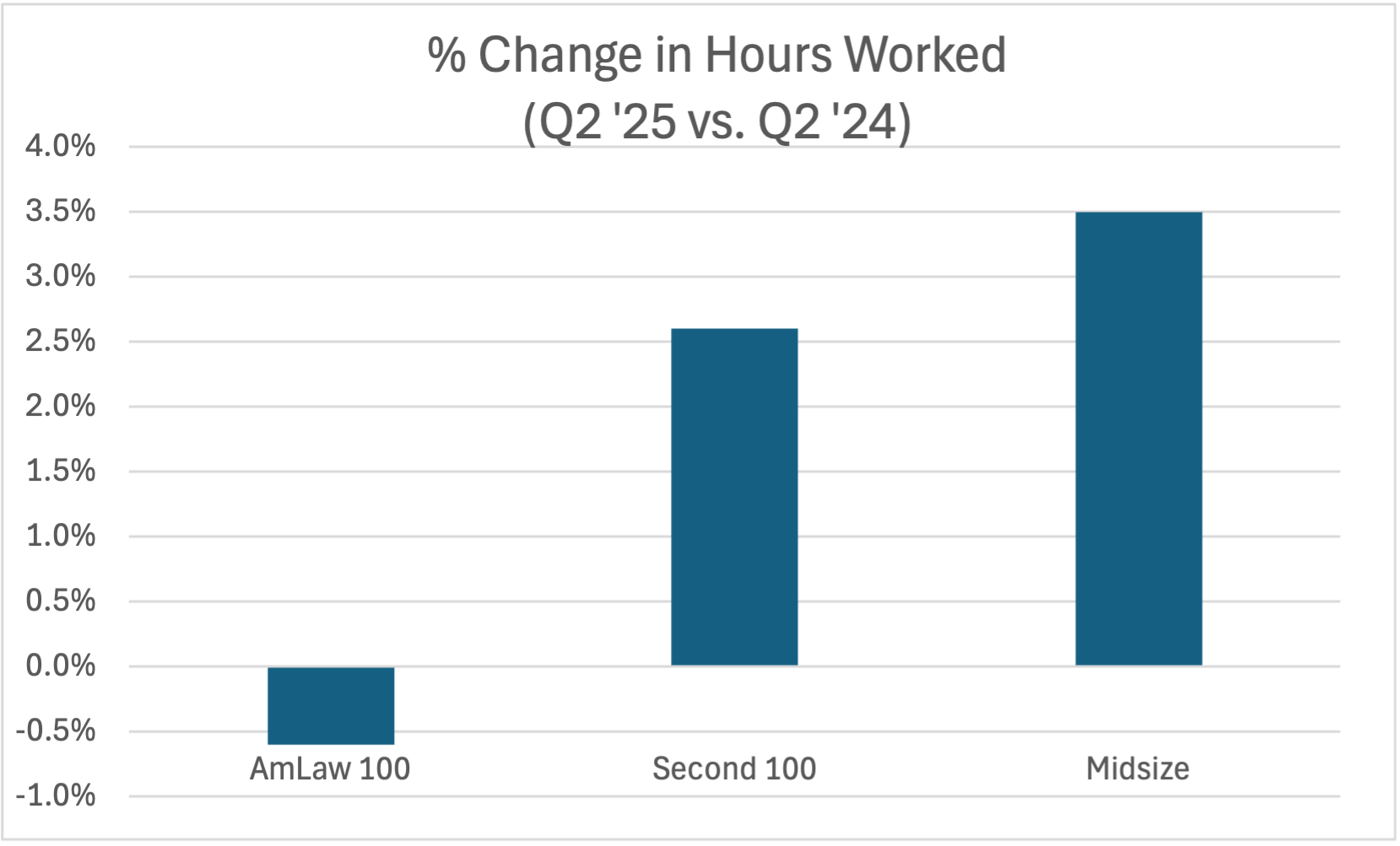

Demand was uneven across segments, however. The Am Law 100 saw a .6% decline, while Midsize firms and Second Hundred firms saw gains of 3.5% and 2.6%, respectively.

In fact, Midsize and Second Hundred firms surpassed AmLaw 100 firms in fees worked growth in Q2 (total hours billed multiplied by average worked rate), despite the AmLaw 100 maintaining a worked rate growth advantage due to its ability to push through rate increases year after year. Impressively, across all segments, "lawyers are generating, on average, 6.3% more in fees than at this point in 2024, which was already considered a banner year," according to the LFFI Report.

Rates Undisrupted

Echoing the LFFI Report's finding of 7.4% worked rate growth in Q2, Citi's Global Wealth at Work Law Firm Group found that law firms’ billed rates in the first half of 2025 grew 9.4% over the same period in 2024 (Billing Rates, Undisrupted, David Gialanella, 8/22/25, Law Firm Disrupted series, Law.com) (see also As Am Law 50 Firms Fraise Rates by Double Digits, Partner Profits Soar, Ryan Harroff, 8/26/25, Law.com, citing Wells Fargo Legal Specialty Group's mid-year survey of 130 law firms mostly in the AmLaw 200, finding 9.2% billed rate growth). The Am Law 50 led with 10.4% and 10.3% billed rate growth in Citi and Wells surveys, respectively. One explanation for rate growth among large firms is that private capital is comprising an ever-increasing share of law firm revenues and "[p]rivate capital clients don’t mind escalating legal fees if it keeps them on schedule" (Rates Undisrupted). Another theory is that AI is making each hour more productive and thus more valuable to the client, who is then more willing to pay for a higher rate (Rates Undisrupted); that theory fails to address the consistent year-over-year rate increases the industry has seen over the last 10+ years, well before the implementation of AI productivity enhancements. Another theory, which likely explains part of the inelastic demand from clients, is that General Counsels are generally risk-averse and feel insulated from criticism over firm selection, if they have selected a brand name firm and something goes wrong.

Collections on agreed upon rates were down in Q2 compared to Q1, but only slightly (90% vs. 90.2%) (LFFI Report). The slight dip may be significant, however, because realization rates typically improve in Q2 over Q1 (LFFI Report).

Demand by Practice Area

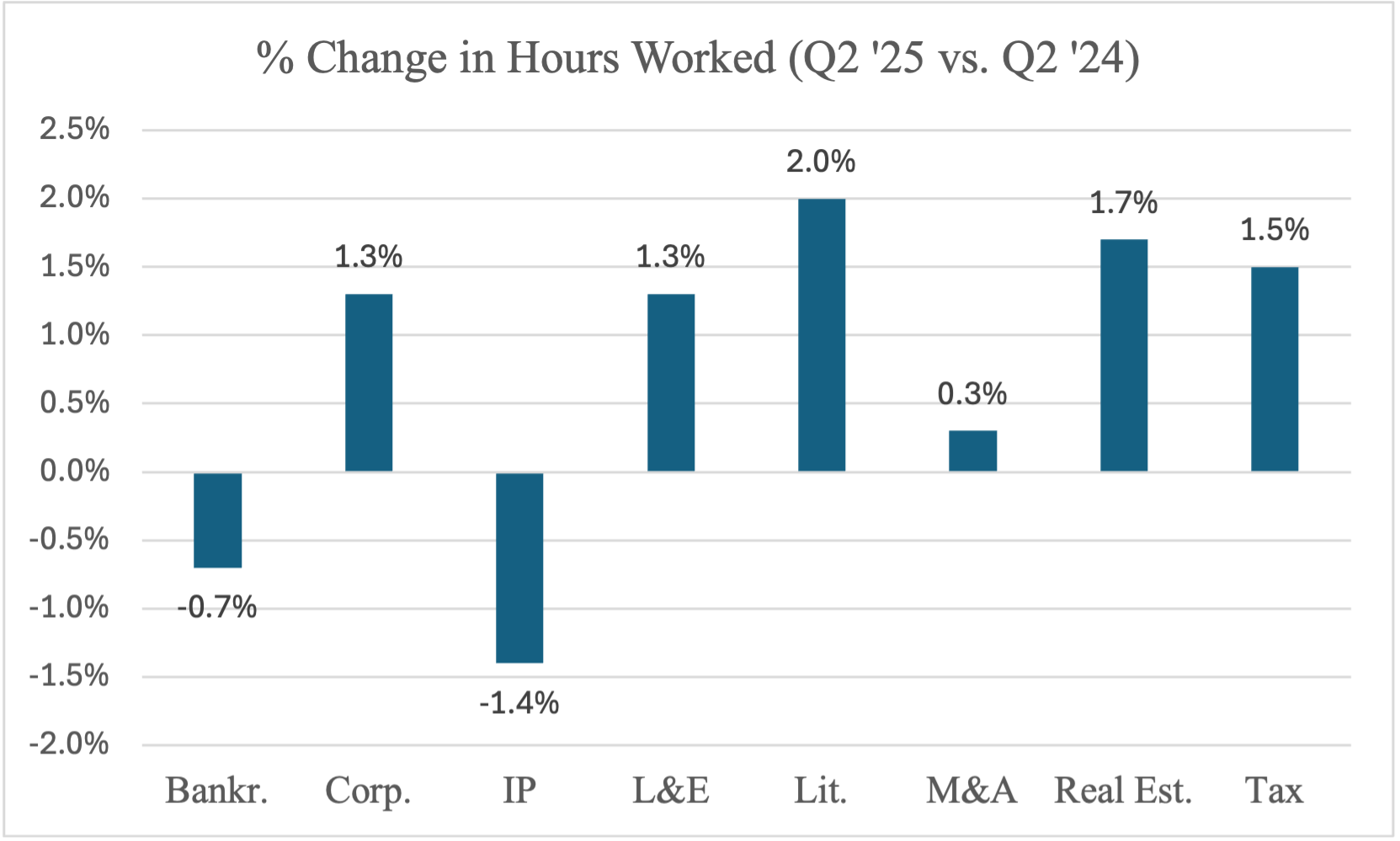

M&A got off to a great start in Q1, but slowed considerably in Q2, registering just .3% demand growth over Q2 2024 (as measured by change in hours worked). Litigation came back to the forefront with 2.0% growth over Q2 2024.